We’ve all seen the commercials: “Bundle and save!” But what does that really mean for you, the policyholder? Is it just a marketing gimmick, or is bundling your insurance a truly smart financial move?

At Priority Risk Management, we know that getting the right insurance is about more than just finding the cheapest price. It’s about getting the best value for your hard-earned money. And for many Indianapolis residents, bundling their home and auto insurance is one of the most effective ways to do just that.

Here’s a look at the benefits of combining your policies and how our independent agency makes the process simple and stress-free.

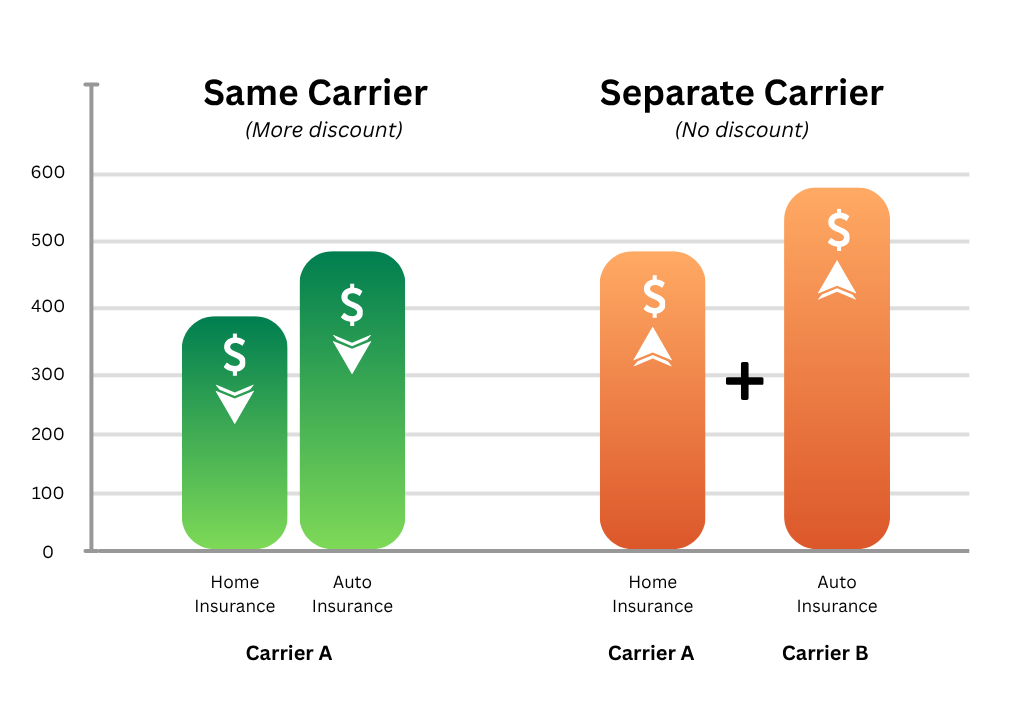

Benefit 1: Major Financial Savings

Let’s be honest—this is the primary reason most people consider bundling. By purchasing multiple policies (like home, auto, and even umbrella or life insurance) from a single carrier, you are often rewarded with a “multi-policy discount.” These discounts can be substantial, sometimes lowering your total premiums by 5% to 25% or more. Over time, those savings can add up to hundreds, or even thousands, of dollars.

For example, a family in Carmel with a bundled policy might pay a single premium that is significantly lower than the combined cost of two separate policies from different carriers. It’s a win-win: you get the coverage you need and more money stays in your wallet.

Benefit 2: Unbeatable Convenience

Dealing with insurance can be a hassle, especially when you have policies with multiple companies. Bundling simplifies your life in a big way.

- One Point of Contact: Instead of calling two different 1-800 numbers, you have a single agent and a single customer service team to work with. This makes asking questions, making changes, or getting advice much easier.

- Streamlined Billing: Forget juggling multiple bills and due dates. With a bundle, you often have just one payment to make, and you can manage all your policy information in one place, whether it’s through an app or a single online portal.

- Simpler Claims Process: In the unfortunate event that a single incident, like a severe hailstorm, damages both your home and your car, you only have to file one claim with one company. This streamlines a stressful process and can even simplify your deductible situation.

The Priority Risk Management Advantage

This is where working with an independent agency like us truly shines. While a “captive” agent can only offer you bundles from a single company (like State Farm or Allstate), we are not tied to just one provider. We have access to a wide range of insurance carriers, each with its own unique discounts and policies.

This means we can do the shopping for you. We’ll compare multiple bundling options to find the combination that provides the best coverage at the most competitive price. We might find that one carrier offers a fantastic deal on a home and auto bundle, while another has a superior option when you add an umbrella policy. Our goal is to present you with the ideal solution for your specific needs, not just a one-size-fits-all package.

Is Bundling Right for You?

While bundling is a great option for many, it’s not always the perfect fit for everyone. The only way to know for sure is to get a personalized quote. Our team at Priority Risk Management is here to help you navigate the options and see how much you could save.

Don’t settle for “good enough” coverage. Contact us today to learn more about the power of bundling and let us find the perfect insurance package to protect your family and your future.