Do you know what the #1 claim in Indiana is? Roofs! Dealing with roof damage can be a stressful experience, but understanding how your insurance policy works can make a world of difference. When it comes to roof insurance claims, two key areas to understand are the payment schedule and the difference between Replacement Cost Value (RCV) and Actual Cash Value (ACV).

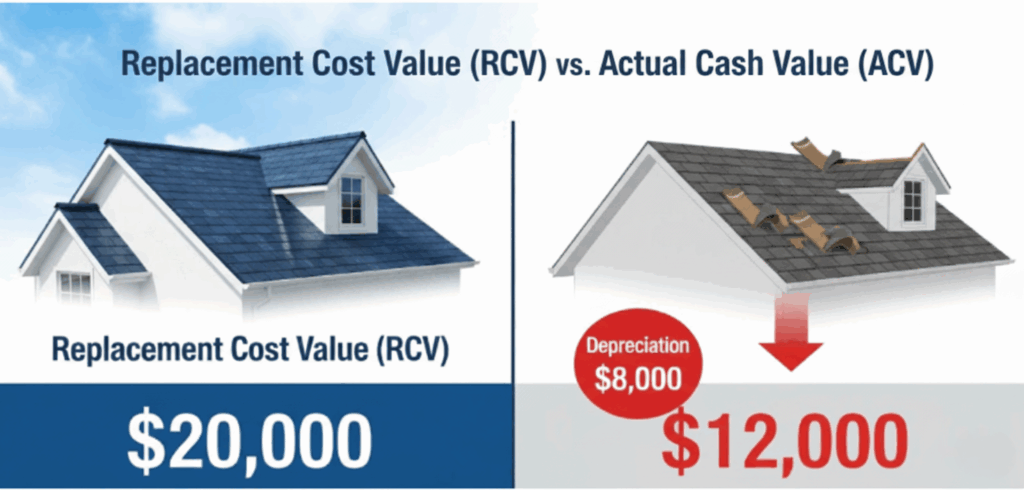

Replacement Cost Value (RCV) vs. Actual Cash Value (ACV)

This is the most important distinction to grasp when it comes to your roof coverage. The difference between RCV and ACV can save you, or cost you, thousands of dollars.

Actual Cash Value (ACV)

Actual Cash Value (ACV) is the replacement cost of your roof minus depreciation.

- How it works: An insurance adjuster determines the cost of a brand-new roof and then subtracts a certain amount for wear and tear, age, and condition. For example, if your roof has a lifespan of 20 years and is 10 years old, the insurance company may only pay out 50% of its replacement value.

- The result: The payout may not be enough to cover the full cost of a new roof, leaving you to pay the difference out of your own pocket. While ACV policies often have lower premiums, they can lead to a significant financial burden after a storm.

Replacement Cost Value (RCV)

Replacement Cost Value (RCV) is the full cost to replace your damaged roof with a new one of similar quality at today’s market prices, without any deduction for depreciation.

- How it works: The insurance company will first pay the ACV, and then, upon completion of the work, they will release the remaining funds that were held for depreciation.

- The result: You receive enough money to completely cover the cost of a new roof (minus your deductible), ensuring you’re not left with a massive out-of-pocket expense.

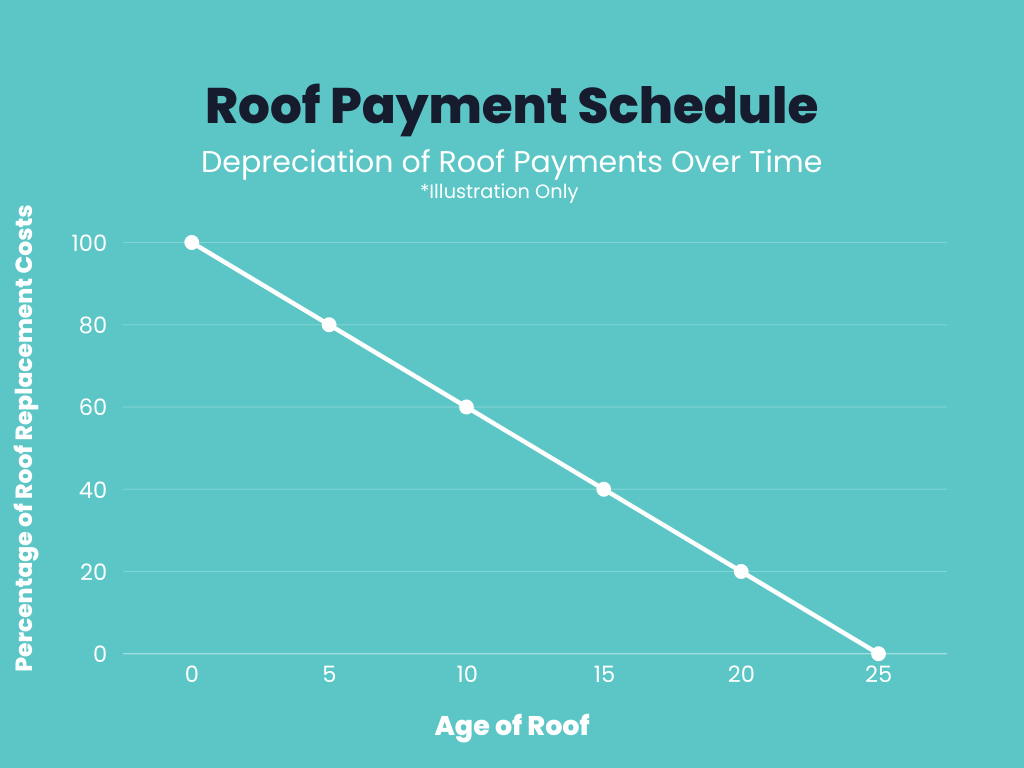

The Rise of Roof Payment Schedules

It is becoming more common for insurance carriers to change a policy to, a “roof payment schedule” or “scheduled roof depreciation”. This is a variation of an ACV policy. It predetermines the payout amount based on a sliding scale tied to your roof’s age, offering a clear and predictable (but often lower) settlement.

The Bottom Line

Before a storm hits, review your homeowners insurance policy. Ask your agent whether your roof is covered for RCV or ACV. While RCV policies may have higher premiums, they offer much greater peace of mind knowing you are fully protected in the event of a total roof replacement. Knowing this information now will help you navigate the claims process with confidence and avoid any costly surprises down the line.

Don’t wait for a storm to hit. Take a proactive step today and review your policy. Contact us now to find out if your roof is covered for RCV or ACV and ensure you have the peace of mind you deserve.