As we approach the holidays many people look to pick up part time jobs in order to earn a little extra cash. Driving for a ride sharing company like Uber or Lyft is becoming increasingly popular here in Fishers, Indiana. Uber car insurance in Indiana is only offered by a few companies and many people don’t realize they need the coverage.

The question I’m afraid my clients are not asking is, “Will my car insurance company pay if I’m in an accident?” If you don’t know the answer to this question then the answer is NO, your car insurance will not cover you.

Recently, my brother became an Uber driver. He said it’s the perfect job for a retiree like himself. You work when you want to and can quit for the day whenever you’d like. When I asked him who he had insurance with while driving for Uber, he responded “my car insurance of course! Also, Uber provides some coverage too.”

Careful, there are some huge coverage gaps!

The Problem with Uber Car Insurance in Indiana

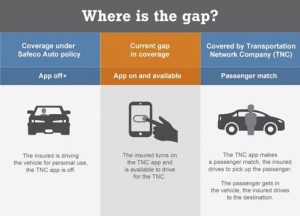

Your car insurance is meant to cover cars for personal use. Once you turn on the Uber or Lyft app, you are functioning as a business. Almost all car insurance policies will not cover you when you are transporting someone for a fee.

If your car insurance won’t cover you, how about Uber? The Uber policy provides minimal coverage once the app is on and you haven’t accepted a rider.

You can examine Uber’s policy here. What happens if you drop off a rider (OR just turn the app on without accepting a rider yet) and then look up and hit a pedestrian in the walkway. You guessed it, you are out of luck.

During the time when the app is on and no trip has been accepted, the maximum Uber’s policy will pay is:

- $50,000 for bodily injury per person and $100,00 total per accident – includes medical expenses, lost income, legal fees

- $25,000 for property damage – damage to someone else’s car

Are you comfortable with this amount of coverage?

What happens if you and Uber are sued simultaneously? Do you have the correct Uber car insurance with your current insurance agent?

Don’t fret there is a solution!

The Solution

That’s why our agency, Priority Risk Management, proudly offers Uber Car Insurance through two of our carriers. Additionally, our standard practice is to provide our clients with at least:

- $250,000 for bodily injury per person and $500,00 total per accident

- $100,000 for property damage

- $1,000,000 for an umbrella liability policy – helps protect your assets and family in the event of a major claim and lawsuit. Provides coverage above limits of your home policy as well.

This coverage is very inexpensive – about $30/year per vehicle. You must purchase the coverage on each vehicle you intend to drive for Uber.

By purchasing this coverage, the insurance company will pay for your legal defense costs as well as bodily injury and property damage that you cause. The solution is simple, recognizing the problem is the difficult part.

Contact us today to get the Uber Car Insurance coverage you need in Indiana!